does kansas have inheritance tax

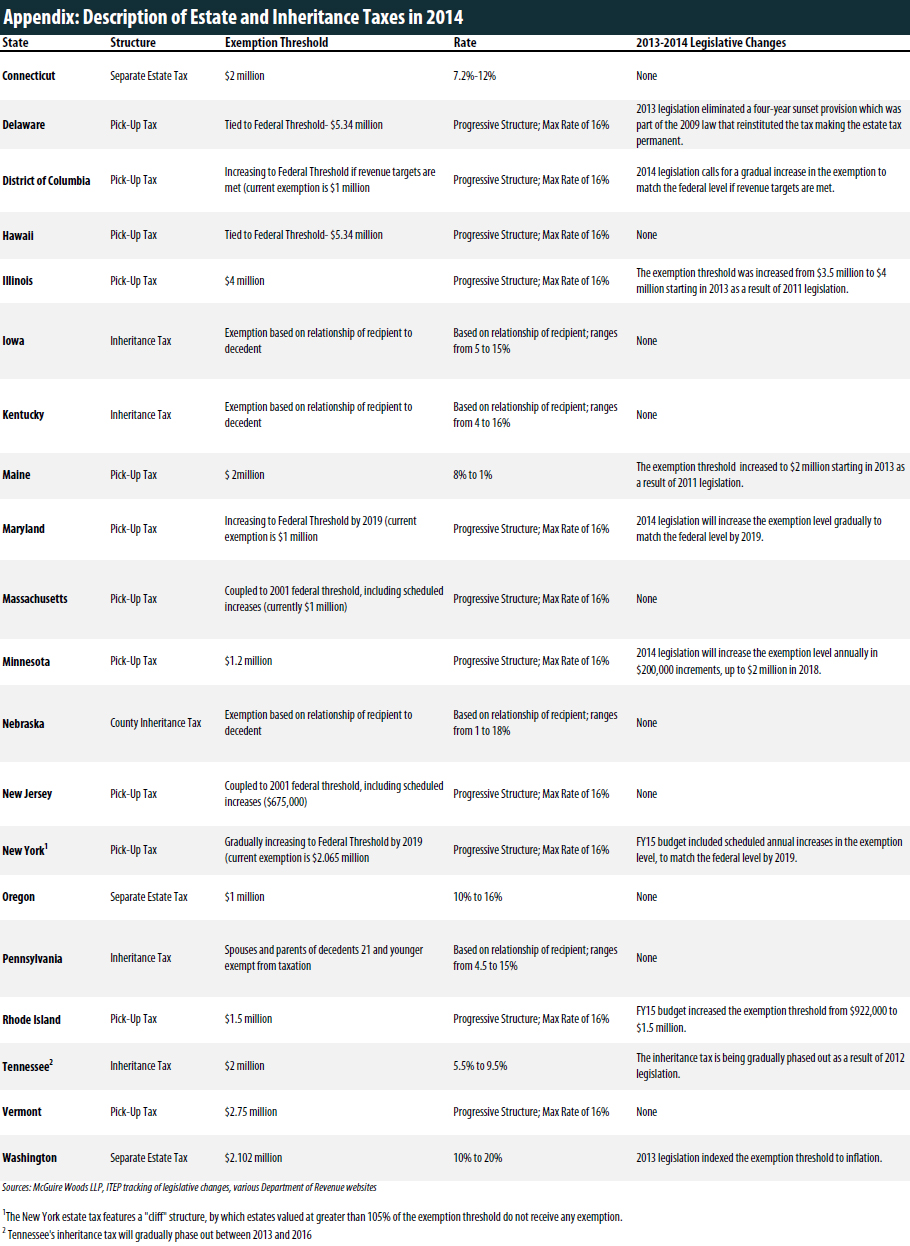

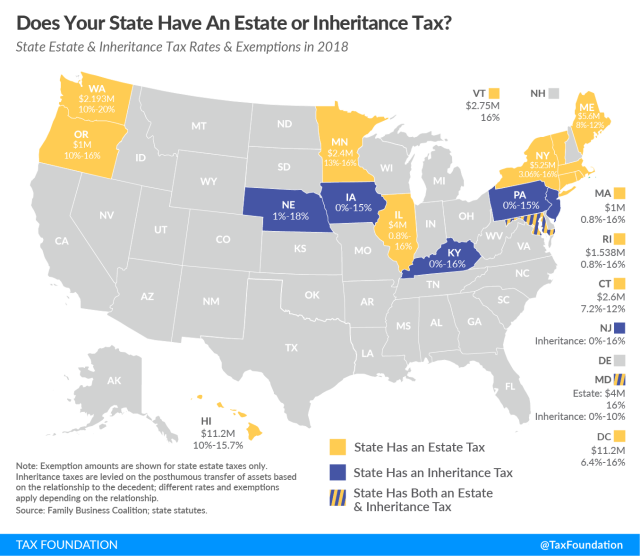

Inheritance tax rates differ by the state. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

Inheritance tax usually applies if the decedent lived in one of those six states or if the property being passed on is.

. However if you receive an inheritance from another state you may be subject to that states estate or inheritance tax laws. Inheritance tax of up to 16 percent. The estate will pay the taxes if a tax is due and liquidate assetsor distribute them outright to beneficiaries.

However another states inheritance tax rules could apply if you inherit money from someone who passes away in another state. Here are some tax rates and exemptions that you should be aware of. To find a financial advisor who serves your area try our free online matching tool.

Ad The Leading Online Publisher of National and State-specific Wills Legal Documents. No estate tax or inheritance tax. That is a recent tax lawchange 2010.

Kansas does have an inheritance tax but it is paid by the estate not the recipient. Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. The estate tax is not to be confused with the inheritance tax which is a different tax.

Where you are doesnt matter. You wont have to pay any tax on money that you inherit but the estate of the person who leaves money to you will be subject to an estate tax if the estates gross assets and any prior taxable gift amounts combined add up to more than 12060000 for 2022. No estate tax or inheritance tax.

Kansas does not assess an inheritance tax either. The state of Kansas does not place a tax on estates or inheritances. Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania.

Beneficiaries are responsible for paying the inheritance tax on what they inherit. The surtaxes are generally uniform. These surtaxes cumulatively raised approximately 24 million in 2008.

Kansas does not have an estate or inheritance tax. An inheritance tax is a tax that beneficiaries who receive an inheritance have to pay based on how large that inheritance is. Only six states have an inheritance tax law on the books.

Beneficiaries are responsible for paying the inheritance tax on what they inherit. Enter your financial details to calculate your taxes. There is no federal inheritance tax and only six states levy the tax.

No city or township has a rate higher than 225 and 36 have a lower rate as low as 025. Kansas has no inheritance tax either. The inheritance tax applies to money or assets after they are already passed on to a persons heirs.

County taxes is 075 and city and township taxes are 225. Since there is no federal inheritance tax in the United States this tax is determined by individual states. Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the baseline rates until 2025 when the tax will be fully eliminated.

These states have an inheritance tax. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware. Inheritance tax is strictly a state-mandated process there is no taxation from the federal government on individual inherited items.

The top rate in 2020 was 15 percent but a reduction of 40 percent brings the top rate to 9. Kansas Inheritance and Gift Tax. Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less.

As of 2021 the six states that charge an inheritance tax are. We have already discussed the fact that Kansas does not have an estate tax gift tax or. Inheritance tax is collected when a beneficiary inherits money property or other assets after someone dies.

Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Individuals should also file state and federal taxes for the decedent in. You dont have a.

Kansas does not collect an estate tax or an inheritance tax.

The Simplified Probate Procedure Oklahoma Probate Advance

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

February 2020 Journal Vol 89 No 2 By Kansas Bar Association Issuu

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Frequently Asked Questions About Probate Kansas Legal Services

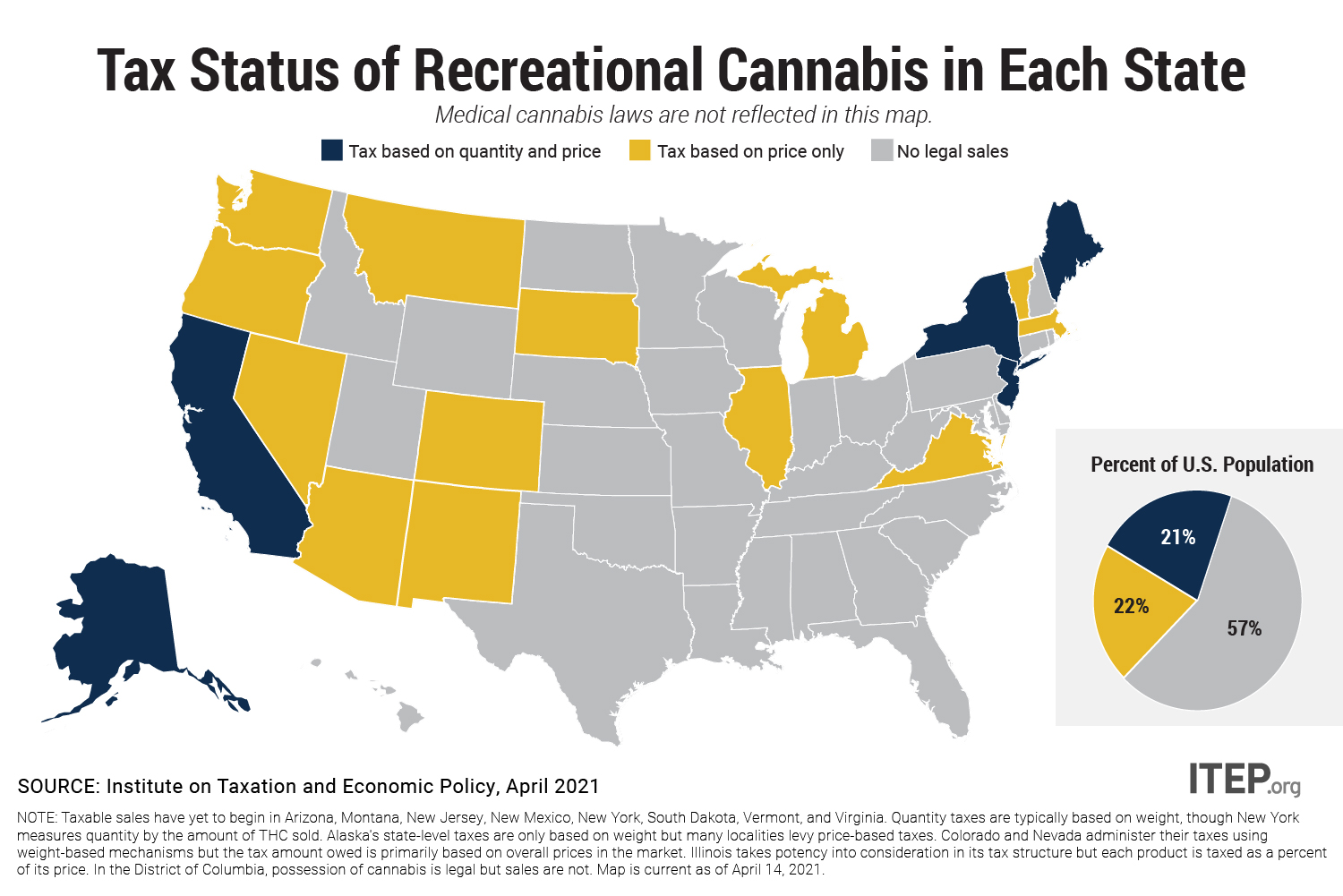

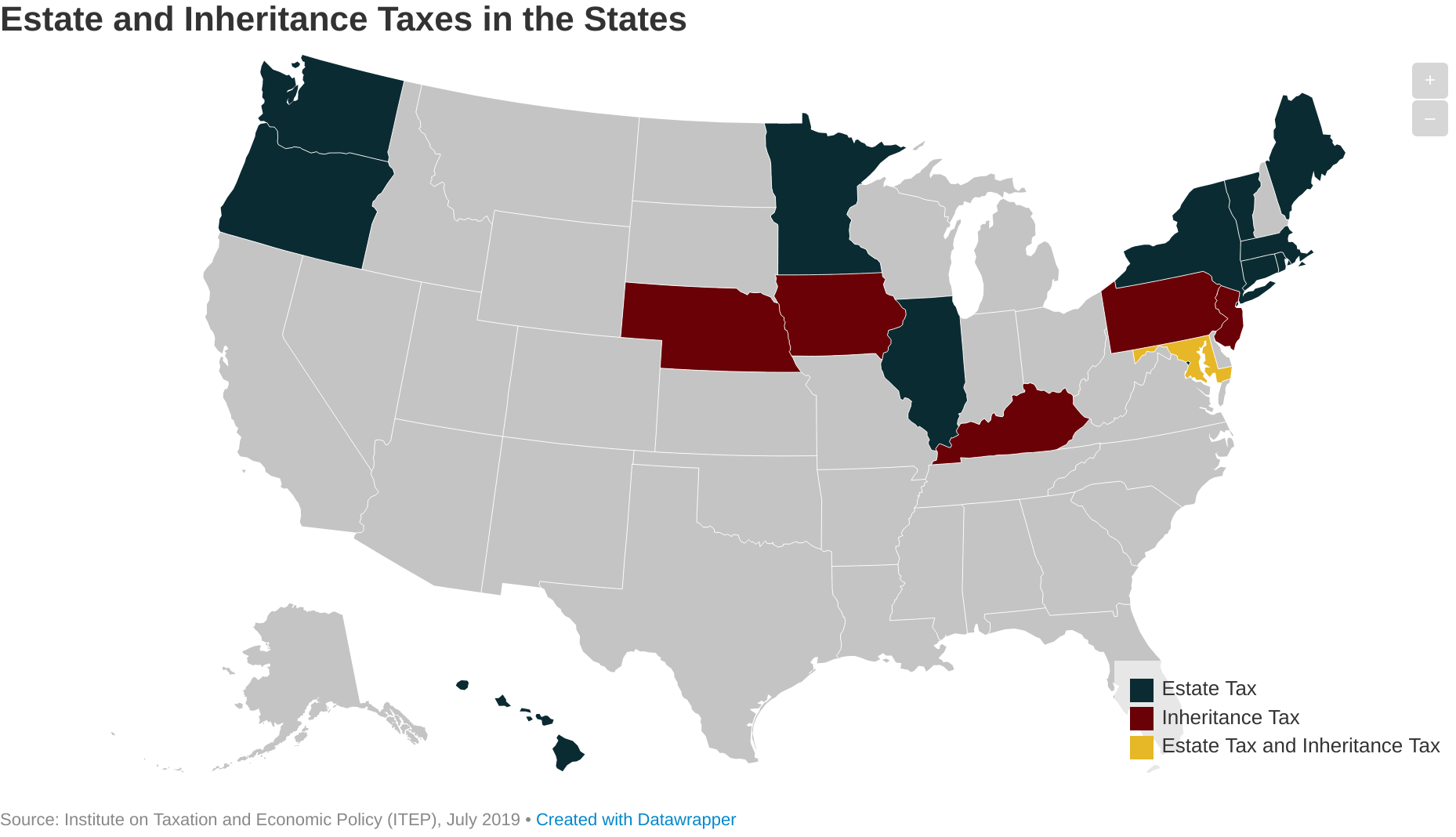

State Estate And Inheritance Taxes Itep

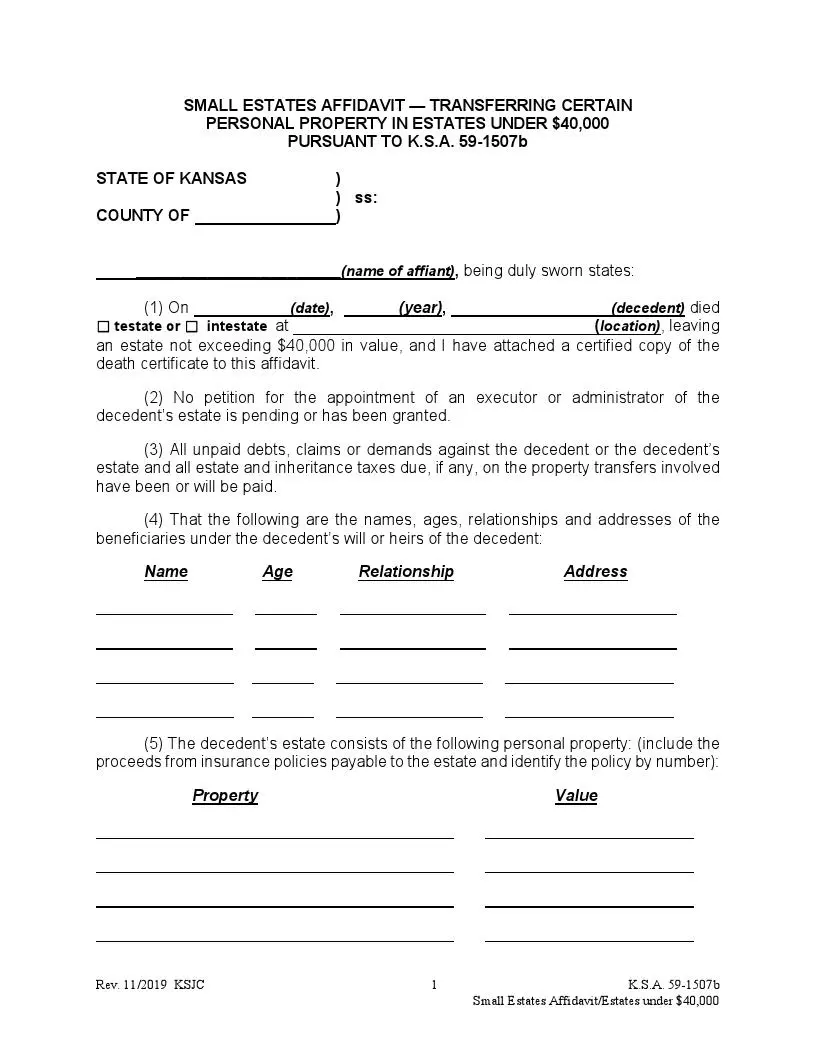

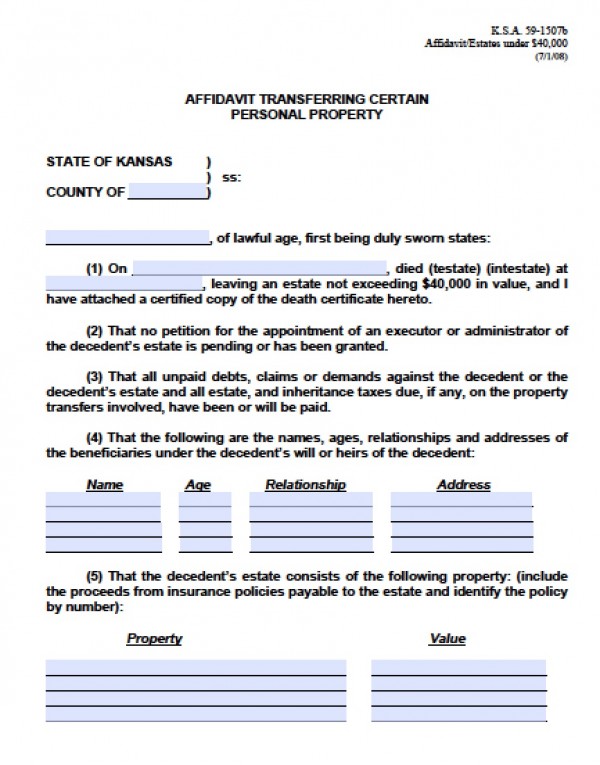

Free Kansas Small Estate Affidavit Form Pdf Formspal

Housing Gurus Answers To What Happens When You Inherit A House

State Estate And Inheritance Taxes Itep

Free Kansas Small Estate Affidavit Form Small Estate Affidavit Form

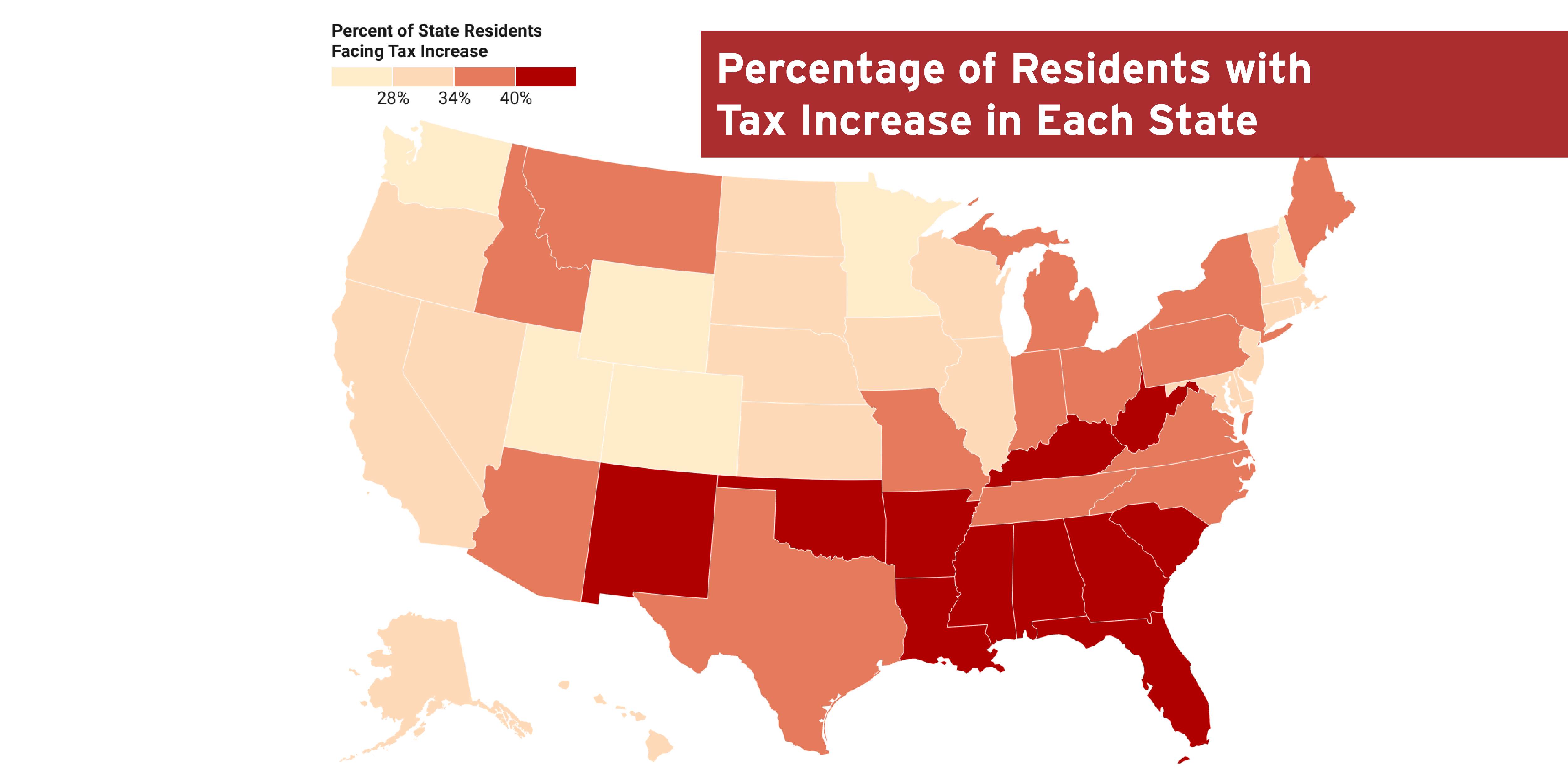

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

/images/2021/08/10/happy-woman-doing-taxes.jpg)

How To Avoid Inheritance Tax 8 Different Strategies Financebuzz

A New Tax Study Should Freak Out Billionaires